How many independent businesses are within the red line?

Independent retail businesses are represented in two colours on the map above. You can hover over or click on them to see a short description. Green refers to those with relocation space, whereas yellow represents those businesses that do not have space.

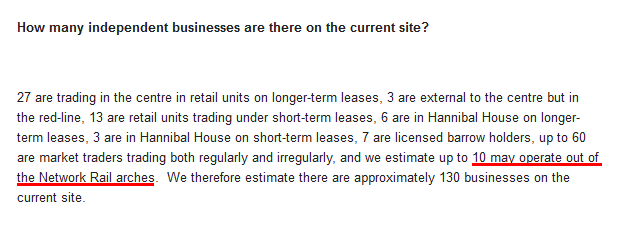

Below is a table of independent businesses that summarises the fieldwork conducted in December 2018, providing evidence of the those operating at that time. However, Latin Elephant has already revealed an email sent from Southwark Council in which they reported there were around 130 independent businesses in January 2018 (the heading of the image mistakenly says summer 2017), 9 of which were based in Hannibal House, the tower above the Shopping Centre.

This could mean that nearly 30 businesses were already displaced as of December 2018.

Under the Section 106 Agreement between Delancey and Southwark Council, all these independent businesses operating within the red line would be eligible for relocation support.

| No. |

Business |

Address |

Level |

Area (sq m) |

Relocation space? |

In FoI? |

How many independent businesses does Southwark Council claim that are operating?

Southwark Council reported in January 2018 that 130 independent businesses were operating in the Elephant and Castle area (the tweet wrongly states summer 2017).

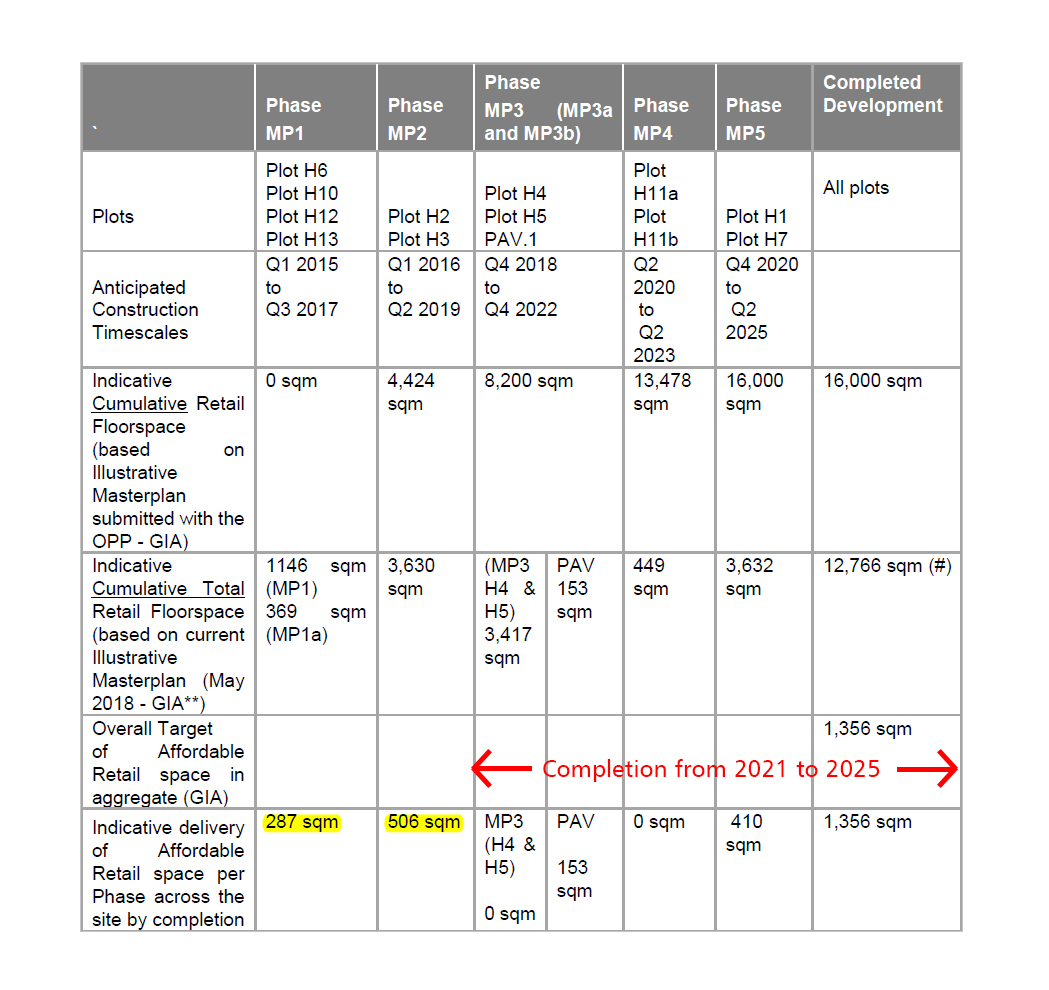

In February 2019, a Freedom of Information request (FoI) was submitted to ask for the list of Independent Traders Southwark Officers had drawn up for their planning report in December 2018. Southwark Council responded with a database showing 79 businesses - see below the original document:

On 21 March 2019, a Southwark Cabinet Member confirmed that only 36 businesses were offered a relocation unit.

In summary, the official figures can be found in the following chart:

What businesses have been excluded in Southwark's database?

We have marked in light green on the map You can hover over or click on the map to see those businesses that have been omitted in Southwark's response (see above).

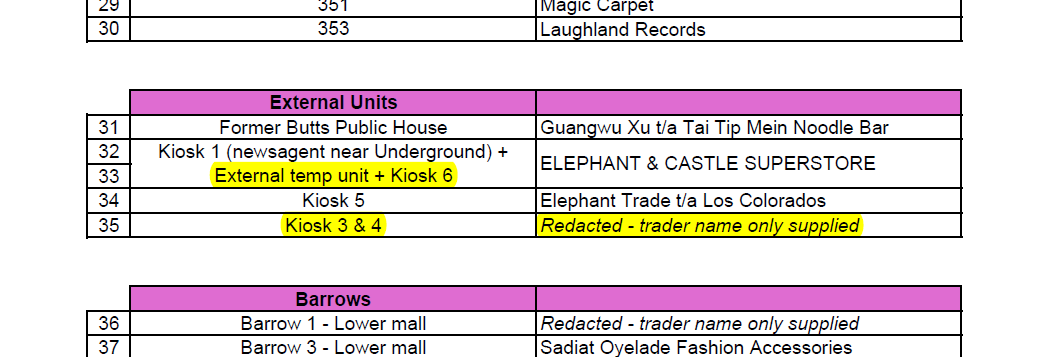

Southwark’s database has some names redacted, and the address of some businesses is in some occasions unclear, especially of market traders and external units to the Shopping Centre. While the units inside the Shopping Centre have been relatively easy to identify by cross-checking Savills’ ground and first floor plans (dated 18 January 2018), external kiosks and market traders were certainly more challenging given the ambiguity of some data in the FoI response.

Find below how we constructed this list, which shows that Southwark's database falls short of over 20 businesses:

| No. |

Business |

Address |

Level |

Area (sq m) |

How many business spaces do Independent Traders have available for relocation?

There are 3 relocation sites offered by either Southwark Council or Delancey: Perronet House (12 units), Elephant One (8 units), and Castle Square (up to 26). The three of them totalled a maximum of 46, yet Latin Elephant has recently discovered that the developer Delancey is only offering 20 units in Castle Square, and only 18 to Traders from the Elephant and Castle area, far fewer than the "up to 32 units" that Southwark Officers reported to Councillors at the Planning Sub-Committee B on 12 December 2018. Traders have first refusal option in these three sites.

The official figures of relocation units for Independent Traders as of April 2019 are as follows: 18 temporary units in Castle Square, 12 permanent units in Perronet House and 8 permanent units in Elephant One (see the second chart below).

The possibility of 30 pitches in East Street market was also raised by Delancey in their

covering letter of the Castle Square planning application (page 2), though it is yet to be confirmed if this will become a real relocation alternative. Southwark Officers also advised Councillors in December 2018 that

this option was available.

Besides the above, Southwark Planning Officers also reported to Councillors that Independent Traders in the Elephant and Castle area could be relocated in Elephant Park, the new development by Lendlease in place of the former

Heygate Estate. After looking into all related documents on the Southwark Planning Register website, we discovered in the

'Affordable Retail Unit Strategy' report that this development offers 1,356 sq m of affordable retail floorspace, yet only 793 sq m would be available for immediate relocation in 2019, when the demolition of the existing Shopping Centre is intended to begin.

The remainder floorspace would be completed from 2021 to 2025. This essential information about the delivery timescale was in fact omitted by Southwark Officers in their report to the Councillors.

Which independent businesses do not have a relocation space as of April 2019?

The official figures set the number of independent businesses with relocation space at 36 out of 100, yet Latin Elephant has been able to confirm 35.

Following the results of the allocation process in March 2019, Southwark Council confirmed in a document sent to Traders, and seen by Latin Elephant, that 68 businesses applied for relocation. It is unclear whether Southwark Council has engaged with all affected businesses operating within the red line, especially those those omitted in their own database of the FoI response.

In this same document, Southwark Council affirmed that those businesses 'that have not been offered space at these sites are therefore equally as eligible for the Relocation Fund [of £634,700] as those that have.'

While we await confirmation from Southwark Council as to why some businesses have been excluded on their official list, we have drawn on our database from December 2018 to conclude that either the following businesses have not been offered a relocation space or have left Elephant and Castle with no alternative plans.

| No. |

Business |

Address |

Level |

Use class |

Area (sq m) |

How did Latin Elephant determine the location and number of the affordable units in Elephant Park?

The location of the units is stated on page 11 of the 'Affordable Retail Unit Strategy' written by DP9, the planning consultant of Lendlease (same as Delancey). In this document, it is said that the intention is 'to concentrate all discounted rent units along Sayer Street'.

To find out the exact number of discounted rent units that would be available for Independent Traders in Elephant Park by 2019, petit elephant conducted mathematical simulations to calculate all possible combinations of retail unit areas that total 793 sq m. In fact, the hypothesis was that Lendlease maximised the number of discounted retail units to the nearest 793 sq m. In this scenario of the traders that could be accommodated, only 8 is the upper limit.

The Section 106 Agreement between Lendlease and Southwark Council for Elephant Park states that affordable retail units should be prioritised to those independent businesses 'that have been displaced as a result of the development within the Elephant and Castle Opportunity Area' (paragraph 27.7.1)

As of April 2019, none of those discounted units have been offered to traders operating within the red line.

How did Latin Elephant know when retail units in Elephant Park are going to be completed?

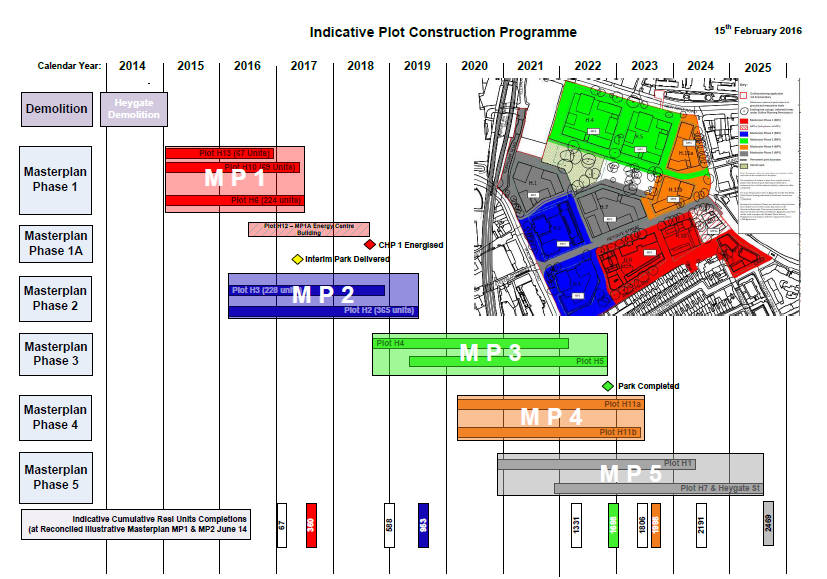

We looked at the phasing programme submitted by Lendlease. As of December 2018, the latest update was made on 15 February 2016 and was elaborated by DP9. Below you can see a screenshot of the construction programme and what each phase entails.

Masterphase 1 (MP1 in red) comprised of plots H13, H10 and H6 (see map above); MP2 (blue), plots H3 and H2 (see map); MP3 (green), plots H4 and H5 (see map); MP4 (orange), plots H11a and H11b and finally, MP5 (grey), plots H1 and H7.

The next two plots to be completed in 2021-22 with 5 market-price retail untis are H4 and H5 on New Kent Road.

How did Latin Elephant build the list of independent businesses that were omitted by Southwark?

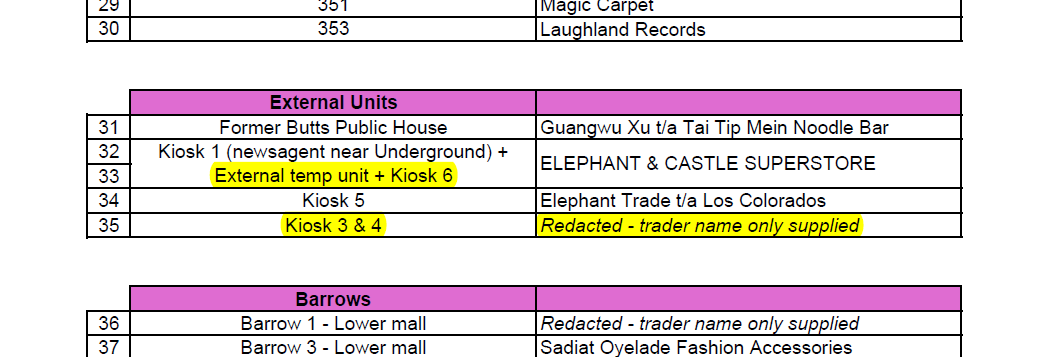

Southwark's database groups Independent Traders into 5 categories: units, external units, barrows, market traders and arches. We intended to independently corroborate Southwark's list with other sources available to us.

The list of internal units and barrows in the Shopping Centre was checked against our own survey and Savills’ ground and first floor plans, which shows the unit and barrow numbers. Both our survey and Southwark's database must have been made virtually at the same time, December 2018, and yet Southwark's list is 7 businesses short.

While we await clarification from the Council, our research shows 2 unit businesses and 5 barrow-holders operating inside the Shopping Centre that are missing in the FoI data set (see our list above). Latin Elephant is aware that some businesses such as London Fashion (unit 306) have left the Shopping Centre after the Castle Square planning application was finally approved in January 2019, but this does not explain why they were ignored in Southwark's database, which was compiled before any final planning decision.

Regarding the external units, the verification methodology was different since we were not familiar with the kiosk numbering, and some business names were also redacted. In this case, the challenge was how to identify the location of 'kiosks 3 & 4' and the 'external temporary unit', so that we can later determine those that were omitted in the FoI response.

Southwark Officers seem to have built their data set in spatial order in the case of the internal units and barrows (from North to South), and we tested this hypothesis in the case of the external units as well.

In their data set, Southwark Officers have marked the newsagent kiosk near the Northern line underground station as 'kiosk 1', and we are also confident of the location of kiosk 5 (Los Colorados). We then inferred 3 business spaces must exist between kiosk 1 and 5 and in fact, there is a

temporary greengrocer's stand opposite kiosk 1, so we deduce that the

two spaces where La Bodeguita operates under the ramp are 'kiosks 3 & 4' on Southwark's list.

As a result of the above, we came to the conclusion that

5 external units were left out, 4 retail businesses and 1 dental practice (32 New Kent Road).

In the arches, in particular arch 7, we are confident and have visual evidence that there are at least 8 businesses operating there (see also the map and the database above). Nonetheless, Southwark Council also confirmed in January 2018 that 10 businesses were operating at that time in the 2 arches, and we know Distriandina trades solely in arch 6.

With regard to market traders, we surveyed 33 businesses in December 2018, but Southwark Officers listed 35. Unfortunately, due to the ambiguity of the FoI response (many names are redacted), we have been unable to identify rigorously which businesses had stopped trading before we carried out our fieldwork study.

How did Latin Elephant build the map?

Besides the fieldwork research in December 2018, the information has been drawn from other sources. Below we show a comprehensive list with all of them:

Why do some businesses not have names in our database?

Due to time constraints, we have been unable to reach out to all traders but we have visual evidence of their presence. Some have already been displaced, but we aim to complete the missing information. We are happy to finalise the database with your contribution and corresponding citation. Please

get in touch with us if you want to share your findings.

Please,

support us to continue our investigative research and to visibilise migrant and ethnic groups in the Elephant and Castle area.

Our map shows businesses and traders that have not been registered in any official map such as Ordnance Survey or Google Maps. With this work, we have given evidence of their existence; but we want to do more.

Latin Elephant is a small charity with limited resources and any contribution, big or small, will help us fund our independent work, which is essential to verify institutional information.

We hope to update this investigation while the regeneration is ongoing, not after it happened, and this would be very difficult without your support.

Please, support Latin Elephant

Thank you

Updates

This post was updated on 23 May 2019 to correct the information regarding Kaieteur Kitchen's relocation and to add a footnote to the tables. A minor amendment is also shown in strikethrough text.